RESOURCES

An Introductory Guide to Alternative Investments

Alternative investments, also known as “alternatives” or “alts,” are investments outside of public stocks, bonds, and cash. They include the private markets (such as private equity or private credit) as well as real assets (including real estate, infrastructure, commodities, cryptocurrency, and fine art). They’re becoming a more popular asset class to help diversify a portfolio and provide separation from the performance of public markets. However, the barriers to entry are generally greater, along with reduced liquidity compared to public markets.

What are Alternative Investments?

When it comes to investments, most people are familiar with public stocks and bonds, opportunities that trade daily and are easily accessible. However, alternatives make up a wide range of assets that fall outside of stocks, bonds, and cash. Due to this separation from the public markets, they may behave significantly differently. Some of the most common alternatives include:

| Private Credit | Private Equity | Commodities | Cryptocurrency | |

|---|---|---|---|---|

Description |

Loans from non-bank entities to private businesses that are not listed on public exchanges. | Equity investments in medium to large businesses that are not listed on public exchanges. | Raw materials such as oil, gas, gold, or wheat that are traded on global markets. | Digital currencies operating on a decentralized system, such as Bitcoin or Ethereum. |

How returns are realized |

Interest payments from the borrowing business to the lender on a monthly basis. | Appreciation in the value of the business, realized when the equity stake or the business is sold. | Price changes based on global supply and demand. | Price changes based on the level of adoption. |

Other well-known alternative investments include real estate, infrastructure, and fine art.

Why are Alternative Investments Growing in Popularity?

Alternatives already account for a substantial portion of the global economy, and the growth of this asset class shows no signs of slowing down. A recent report estimates that private credit is on track to reach $5 trillion in global assets under management (AUM) in the near future.

Private credit, in particular, has experienced significant growth since the global financial crisis in 2008. As corporations found it more challenging to secure capital from traditional banks, investment funds seized the opportunity to lend directly to businesses outside of public markets. For businesses, the benefit is often quicker access to capital and more customized lending arrangements than those available through traditional banking institutions, which often have more standardized agreements.

For investors, the traditional 60/40 portfolio (60% invested in stocks, 40% in bonds) has long been considered the gold standard in portfolio composition. However, persistent inflation, higher-for-longer interest rates, and market volatility have reshaped how investors think about diversification, leaving them to seek investments that are less correlated to public markets.

What are the Benefits of Alternative Investments?

One of the primary benefits of alternative investments is increased diversification. Different economic forces drive many alternatives compared to public markets, such as the change in the supply or demand of a commodity like oil or gas, contractual loan repayments, or the growth and expansion of a private company.

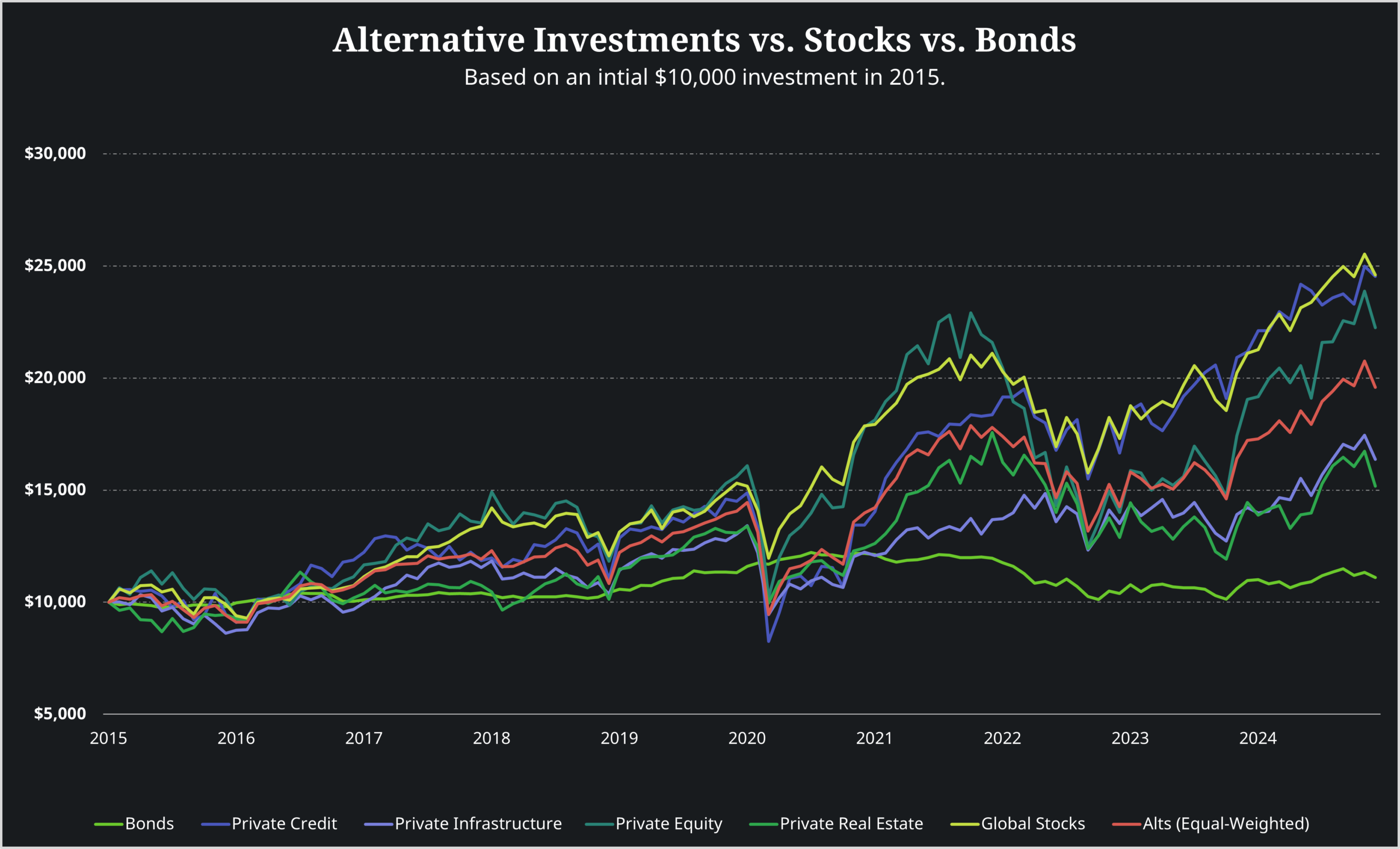

Another potential benefit of alternative assets is that they may offer higher returns when compared to traditional investments. The chart below compares the performance of different alternative assets, global stocks, and bonds between 2015 and 2024.

Note:

The chart above is provided for illustrative and educational purposes only. It is not intended as investment advice or a recommendation to buy or sell any security. To approximate the performance of different asset classes, we used publicly available exchange-traded funds (ETFs) as proxies for categories such as private equity, private credit, real estate, and infrastructure. These trade daily on public markets and may behave differently from the private, less liquid investments they are meant to represent. Returns are based on historical data. Past performance is not indicative of future results.

Key Considerations Before Investing in Alternatives

The considerations associated with alternatives depend on the type of asset and the specific details of the fund you invest in. However, here are some of the primary factors that need to be considered:

Illiquidity:

Unlike public stocks that can be bought and sold during the hours a market is open, many alternatives are intended as long-term investments that reduce your liquidity or the ease with which you can redeem your investment. Some alternative investment funds offer monthly or quarterly liquidity, while others, such as venture capital, require a lock-up period of several years before returns can be realized.

Higher cost of entry:

Alternative assets often require a higher minimum investment compared to stocks or bonds. Additionally, due to the complex nature of the investment, specialized knowledge is required to manage it, which can also incur an additional fee for the investor.

How Can Canadians Invest in Alternative Investments?

When considering investing in alternatives in Canada, it is not as simple as only picking a fund or strategy. There are stringent sets of regulations and eligibility criteria to navigate. These are complex, vary by province, and can affect which products you can access.

Due to this complexity, it is highly advisable to work with a registered financial advisor when considering alternative investments. An advisor will be able to help with:

- Understanding an investor’s eligibility for certain funds

- Performing due diligence on a fund

- Ensuring compliance is maintained with regulations

- Matching the right investment to an investor’s needs and goals

About Invico Capital Corporation

Invico Capital Corporation is an alternative investment fund management company based in Calgary, Alberta, Canada. We manage a series of funds that invest in alternative asset classes across North America using capital from Canadian investors. Our funds primarily focus on private credit via direct lending, syndicated loans, and the secondaries market, as well as commodity investments in oil and gas.

We prioritize supporting investors by making long-term decisions that align with our core investment philosophies. This means we avoid chasing trends, which has enabled us to successfully navigate complex economic cycles for more than two decades. To learn more about investing with Invico, visit our “How to Invest” page.

Glossary of terms

As with all financial investments, you are likely to come across a variety of terminology that may be confusing. Here are some of the key terms and what they mean:

- Alternative investments (“alts”): Assets and investment strategies that are not part of public stocks, bonds, and cash.

- Liquidity: How quickly an investment can be turned into cash. Higher liquidity means quicker access to cash; lower liquidity means money can be tied up for longer periods. Generally, lower liquidity is associated with higher returns.

- Private markets: Investing in or lending to businesses that are not publicly traded. For example: private credit, private equity, and secondaries.

- Private credit: Loans provided by non-bank lenders to companies or projects.

- Real assets: Physical assets like real estate, infrastructure, commodities, and cryptocurrency.

Notes and disclaimers:

This article is intended for educational purposes only and should not be considered as investment advice, a recommendation to buy or sell assets, or any other kind of professional advice. If you are interested in learning about Invico Capital Corporation’s investment funds, visit our How to Invest page or speak to your financial advisor.

Contact

Contact Our Investment Sales Team

Interested in learning more about how to invest in private markets? Our team is here to answer your questions and guide you through the process. Whether you’re a financial advisor, institutional investor, or family office, we’re happy to provide insights on our investment solutions. Fill out the form below, and a member of our Investment Sales Team will get in touch with you.